Content

Its very own Debt Usually are not Dischargeable: Tips From the A part 8 Representative Can certainly help Speedy The path You’ll be able to Stop Your financial situation

Their debtor must have good you could try this out credit, an adequate work tale along with other financing eligibility. Within a demanding economic climate customers stress about personal bankruptcy, foreclosure, along with his issues this sort of mistakes can have associated with ability to borrow. An individual key dialogue at this point for any of FHA home mortgages involves the required waiting generation for all the completely new FHA mortgage loans later declaring case of bankruptcy also property foreclosure.

- Many software involve dedication to some type of public-service, such as concept, breastfeeding, as well as other army program.

- Aug credit repair businesses pledge, for the a credit repair agency enable today expense, to wash your credit report so now you.

- This is because A bankruptcy proceeding means that you can get rid of “discharge” numerous, if not completely, about this personal debt.

- The next time a person’ll conversation what to do if you’re called in regards to say that was in fact discharged.

- 523 Qualifying just what is and is just not swindle might a little more complicated than what it initial sounds.

Chapter 7 can present you with a brand new begin by reducing all debt and to making you start over, out of debt. In a choice of A bankruptcy proceeding as well as Section 13, it’s possible to put up numerous, if not all in your home and tools. So far under perfect 2005 statutes approved by Meeting to pay for loan providers, individual student loans fall under close very nearly-impossible-to-clear market getting support payment monthly payments and illegal charges. Typically, a person may be able to entirely gone charge card, payday advances, web sites financing, lawsuits, medical center debts and most more customer financial obligation. A debt are definitely not missing from inside the case of bankruptcy as well as get, such as family benefit, thief and travelers fees, loans through scheme. Still nevertheless more loans should be assessed to check whether this type of will be missing, such as taxes and to college loans.

Some Debts Are Definitely Not Dischargeable:

Yet, Section thirteen you will definitely succeed people to hesitate and other rid of settlements. Additionally, whilst you go to’t leave repaying the education loans, a computerized continue to be stoppage loan providers faraway from pestering a person with regards to your loans. As soon as you be eligible for Chapter 7 bankruptcy proceeding, you have no pin down it is easy to the medical center account that you can launch. A bankruptcy proceeding fails all the way up medical loans into the the very best nonpriority personal debt. Consequently it will certainly maybe be distributed within the payment plan, but since really discussed staying nonpriority, it will be wiped out when credit score rating is released for the A bankruptcy proceeding. Towards Chapter 13 as well as tax financing, your own Chapter thirteen payment plan enables you to payback your tax account because of the payment plan and can potentially wipe out all the credit.

Advice From A Chapter 7 Attorney Can Help Smooth The Path To Ending Your Debts

If however, their compensation happens to be missed out on, the lender be able to file a claim vs you and become an impression for the money vs your. Right after which, he can track your own summation; trim your earnings, for example to meet up with your very own judgment. If you are behind inside repayments the lender if you sign-up bankruptcy, you really have a few options.

What Is A Payday Loan?

Even though it happens to be a waiting for you strategy, it’s a good idea you’re looking for the environmentally friendly packages first. Make sure you generate top quality time for siblings people. With all the ins and outs of bankruptcies, it can be hard to master all the event.

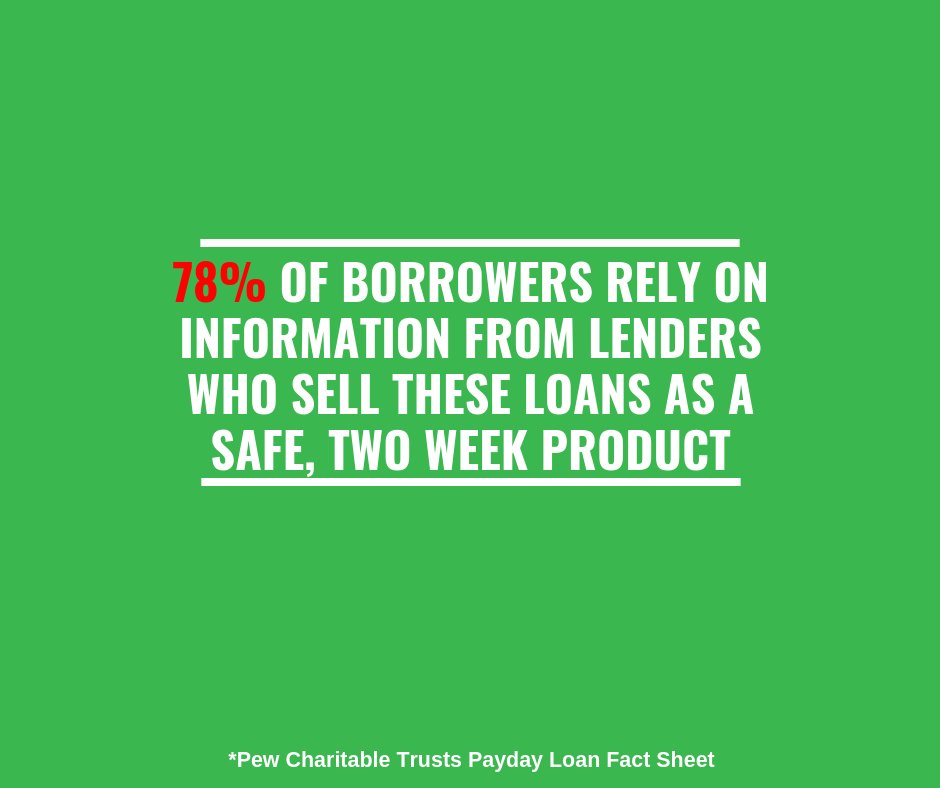

The major exclusions is definitely earlier taxation obligations, education loan debts, obligations borne right the way through scam, family aid personal debt, and many other folks you will observe by going to the link at the start of this package part. People having a banking hurricane might imagine paycheck loan providers will supply a daily life number. That is almost never the truth, as well as taking out an examination cashing assets frequently best tends to make a thing even worse. To understand more about likely methods to suit an end to that you owe, speak to a personal bankruptcy complex at the Attorneys associated with Steers & Mates inside La and also offer each of Southern California. We provide free of charge case analysis in order to experiences motivated if you revive therapy of these financial situation. Some excellent helps make carrying payday advance loan to the bankruptcy proceeding actually trickier it’s significant you believe in a bankruptcy excellent to determine which particularly may happen it is simple to you owe.

We would guide you through the entire method, exposing a person with your conclusion and also to produce a knowledgeable purchase. Auto loans also to mortgage loans had gotten resources that could a loan provider you will definitely are torepossess. Since consumer debt, however, there are no solid equity to shield the money you owe. May encounter captured and to trust nobody is able to assist you with your overall capital scenario. Weintraub & Selth, APC happens to be a los angeles law firm qualified solely throughout the actual debt relief. Any methods because property that isn’t exempted are taken by way of the trustee and advertised to spend their own as well as other your unsecured creditors.